Secure Platform Funding makes money closing real deals with real customers we have zero interest wasting time on fraudulent deals so in an effort to help our clients and brokers better identify fraudulent transactions here is an example we received today of a Deal that is red hot Swift.net fraud.

1/ Recently we published an article titled WARNING: The Unrated Bank Guarantee Scam where we said the following about a Swift.Net Fraud Scam.....

This is a very sneaky scam where the Bank Guarantee or Standby Letter of Credit Provider says they can ONLY deliver the bank guarantee on swift.net instead of swift.com. That statement alone is a huge red flag! ALL real banks and ALL real bank guarantees or stand by letters of credit are normally transmitted and delivered on the swift.com bank to bank system that is used and recognized by all rated banks worldwide or DTC or Euroclear. Any bank who says they cannot deliver on swift.com is saying i don't have access to the "real" bank guarantee and standby letter of credit delivery system, I can only use swift.net which is a completely different system by a very similar name. Swift.net DOES NOT HAVE ANYWHERE NEAR the credibility, recognition, security or acceptance of swift.com.

And the biggest secondary issue with swift.net is that messages often do not arrive directly at the destination because they have to be "downloaded" to be read. If you don't know a message is coming and you don't download it then you never know about the message and therefore its impossible for you to reply!

Many Providers use swift.net to send a worthless Bank Guarantees, Standby Letters of Credit or Blocked Funds to the client on the widely unrecognized swift.net service, then when no one at the clients receiving location acknowledges the message because they didn't know to download it, the bank guarantee provider claims they delivered the Bank Instrument as per YOUR Bank Instrument Supply Contract and YOU breached YOUR contract by NOT replying to the swift.net message so they are keeping your deposit. Its just another sad old scam to take your money repackaged in a new way.

2/ We also published this article titled The Blocked Funds Email Scam, the below Blocked Funds Swift.net fraud example is a hybrid of a Swift.net Fraud Scam AND the Blocked Funds Scam. The scammers seem to have taken a little from each strategy so we thought we would reward their ingenuity by exposing them!

Why is this a Swift.net Fraud Scam?

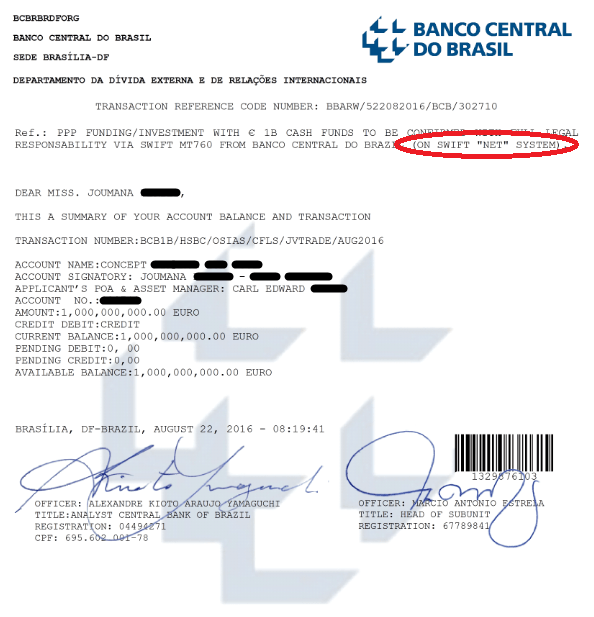

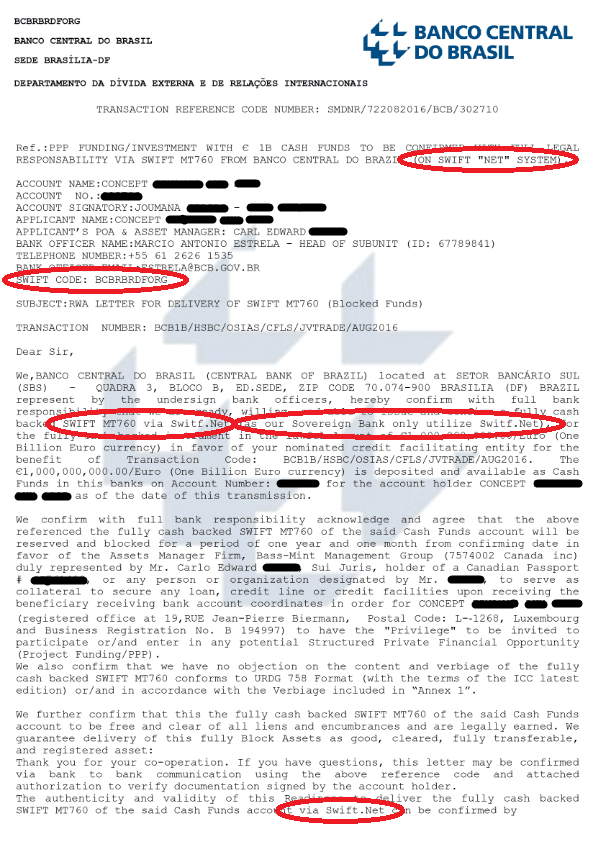

The below Banco Central Do Brasil Blocked Funds Swift.net Fraud example contains actual live documents that were received by Secure Platform Funding on the 27th August 2016 from a broker, out of courtesy for those named in the transaction documents we have redacted some information so the below detailed analysis of the documents is not too embarrassing for those that were originally named.

Please view the documents below and then read the detailed analysis underneath them to understand how fake these "live" documents are:

Swift.net Fraud Example 1

Swift.net Fraud Example 2

Swift.net Fraud Deal Analysis

Warning 1: Swift.net is not the primary recognized platform for major rated banks to complete 1 Billion Dollar transactions! Swift.com is the internationally recognized and endorsed platform All Rated Banks utilize.

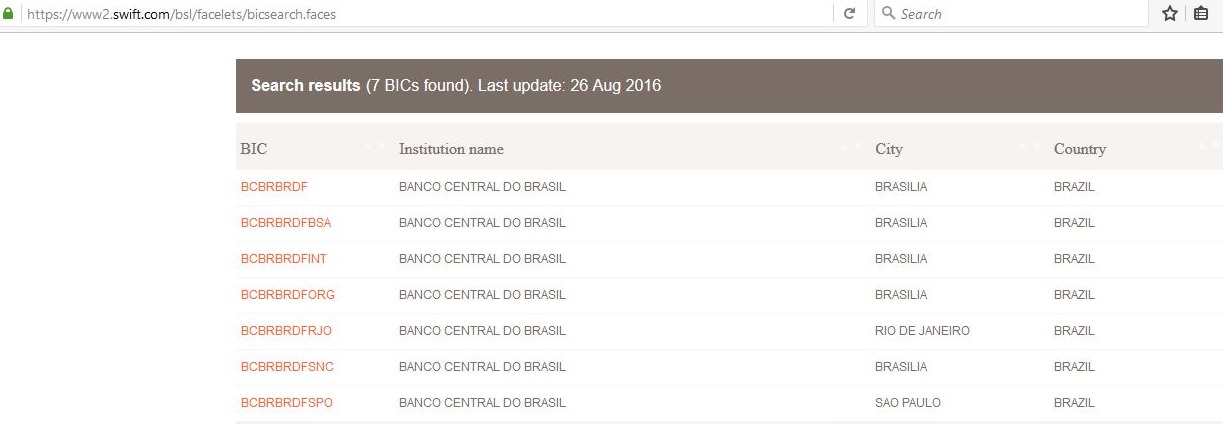

Warning 2: The above transaction is listed as a Swift.net transaction but the documents contain the Swift.com SWIFT CODE: BCBRBRDFORG. So what is a Swift.com Code doing on a Swift.net Transaction?

Warning 3: The words Swift.net are misspelt "Switf.net" not once but TWICE! Banks don't make mistakes, there are two Bank Officers that sign off every Bank Instrument transaction. Both Bank Officers are employed to check every aspect of the Bank Instrument text before it is released. It is impossible that two different bank officers failed to see "Switf.net" spelt wrongly in the Bank Instrument text TWICE!.

Warning 4: The fact that "Switf.net" is spelt wrong invalidates the entire Bank Instrument making it worthless! Maybe the instrument issuer spelt "Switf.net" wrong deliberately for that exact reason!

Warning 5: The Bank Instrument text says "as our Sovereign Bank only uses Switf.net" that is a blatant lie!

A) Below is confirmation from the Swift.com website that Banco Central Do Brasil has no less than 7 Different Swift Codes on Swift.com that the bank uses every day for thousands and thousands of transactions. It is completely untrue to state that the Banco Central Do Brasil "only uses Switf.net" when clear public evidence exists BOTH on Swift.com and Banco Central Do Brasils own web site that disproves this.

B) Banco Central Do Brasil isn't a little bank, it is the Central Bank of Brazil that controls the entire Brazilian economy! To say that the Central Bank of Brazil controlling billions of dollars of the Brazilian Economy doesn't work on any other bank transaction network apart from Swift.net is total lunacy!

Swift.net Fraud Summary

The above Bank Instrument is as fake as a $3 Bill! Our strongest recommendation is that if you have a real client with with a real transaction make sure that transaction is completed on Swift.com, Euroclear or DTCC. Swift.net has too much fraud associated with it for any bank to want to complete a significant Bank Instrument transaction using that network.

Secure Platform Funding ONLY wants to complete genuine transactions, our Compliance Department screens out a ton of fraudulent deals every week. Fraudulent deals hurt clients, waste time, damage supplier relationships and cost money. We hate them and that's why we wrote this detailed article exposing the Swift.net Fraud that exists and encouraging our clients and brokers to stay well away from it. Be informed and be safe.