Secure Platform Funding wants our Brokers to be Outrageously Successful, Highly Paid, Totally Protected and Very Happy!

The Shocking Truth is.... Financial Instruments Industry Statistics confirm less than 1% of Brokers have ever CLOSED a deal or been PAID a transaction settlement commission.

In other words 99% of Brokers are BROKE and 1% are Multimillionaires!

Secure Platform Funding wants to help you achieve Broker Success and get you into the 1% Club! The 1% Broker Success Club enjoy success because they:

- Do things differently!

- They operate differently!

- They think differently!

As a result the 1% Brokers get Rewarded Differently and they make Millions and Millions in Commission. The 1% Broker Club are the Olympic Gold Medalists who consistently win and close deal after deal after deal.

So we thought we would share the 9 Secrets to Broker Success to help empower you to achieve more Success and start Banking Commission Payments instead of Overdraft Fees!

Broker Success Secret 1: Its a Business NOT a Hobby

Broker Success Secret 2: Be Selective

Broker Success Secret 3: Time is Money

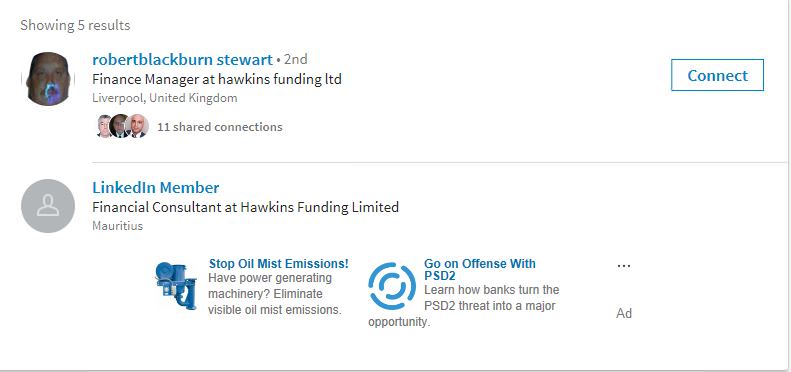

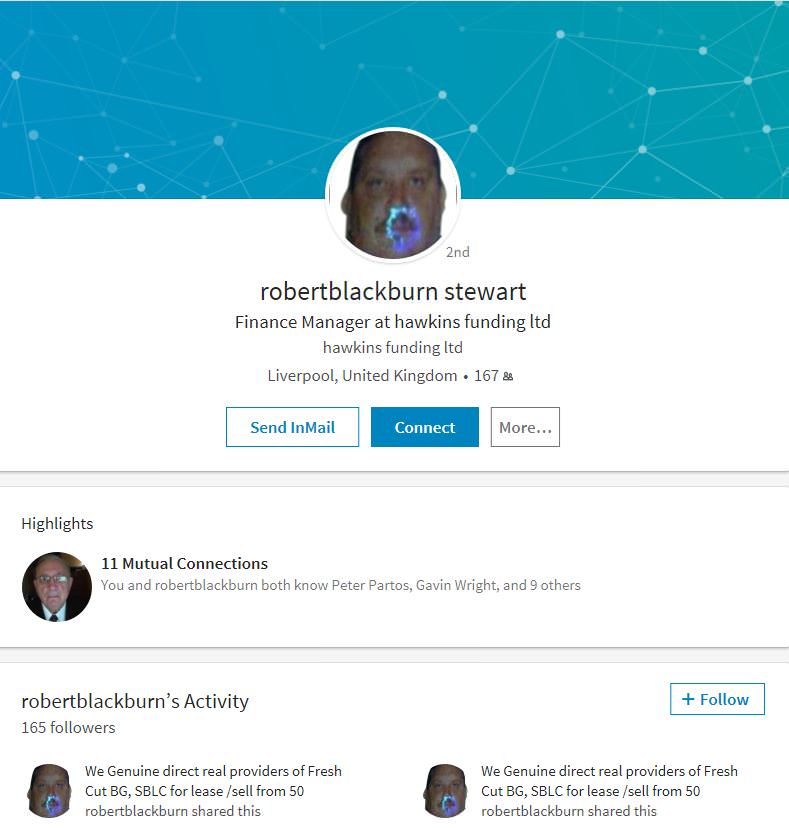

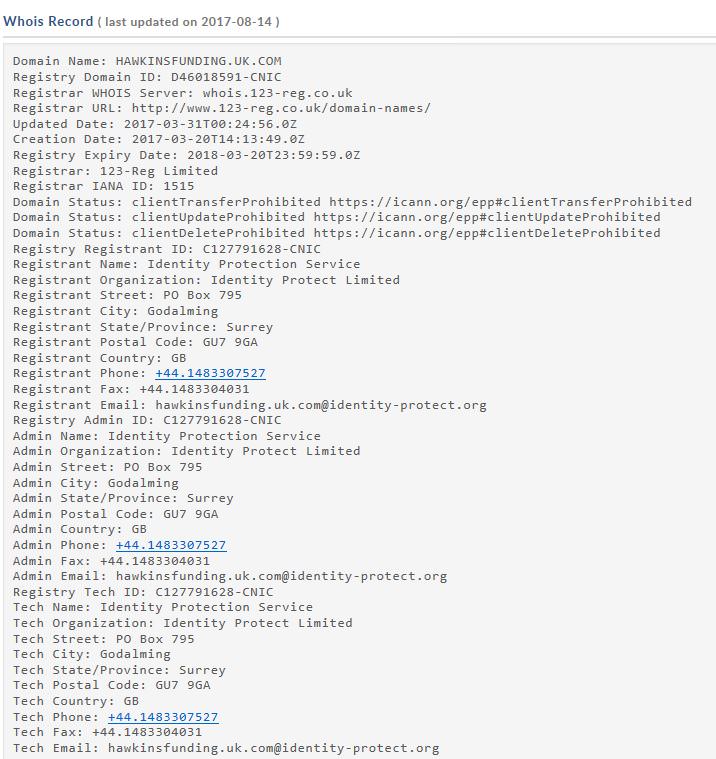

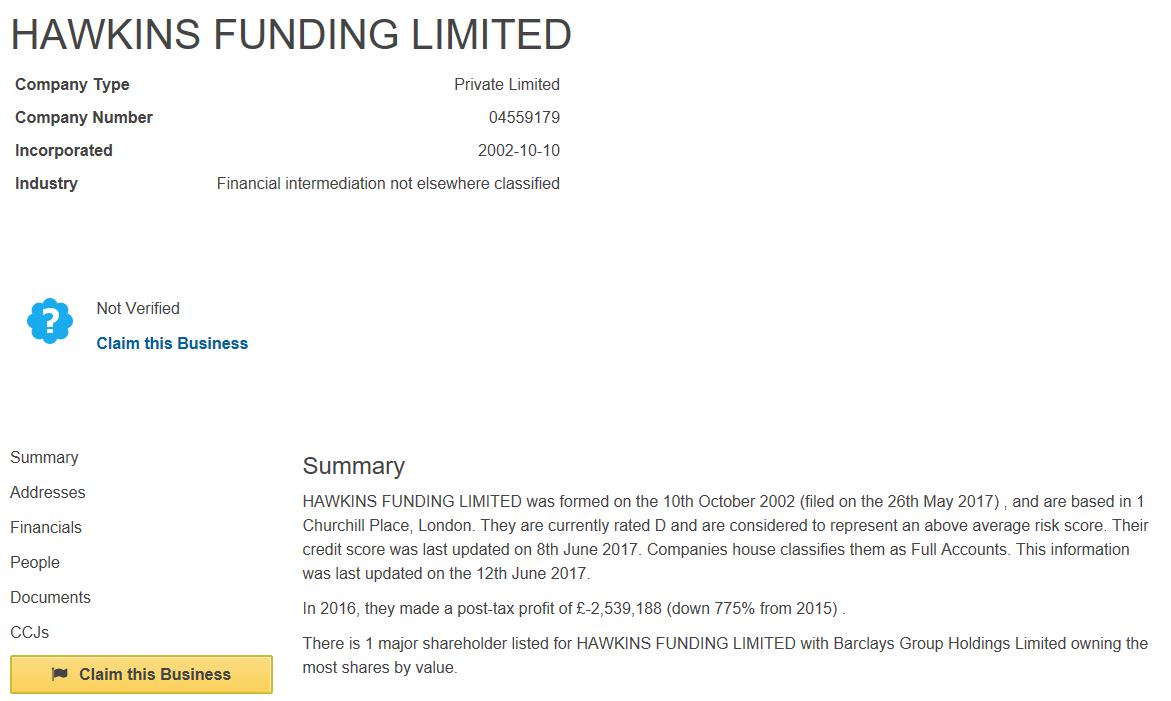

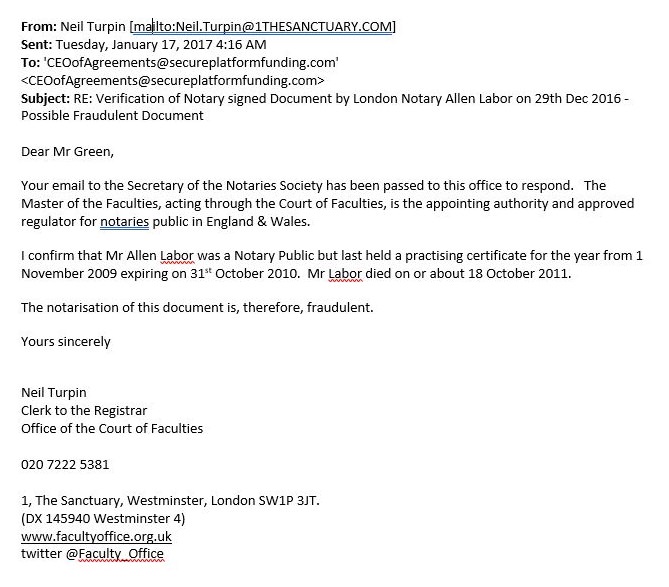

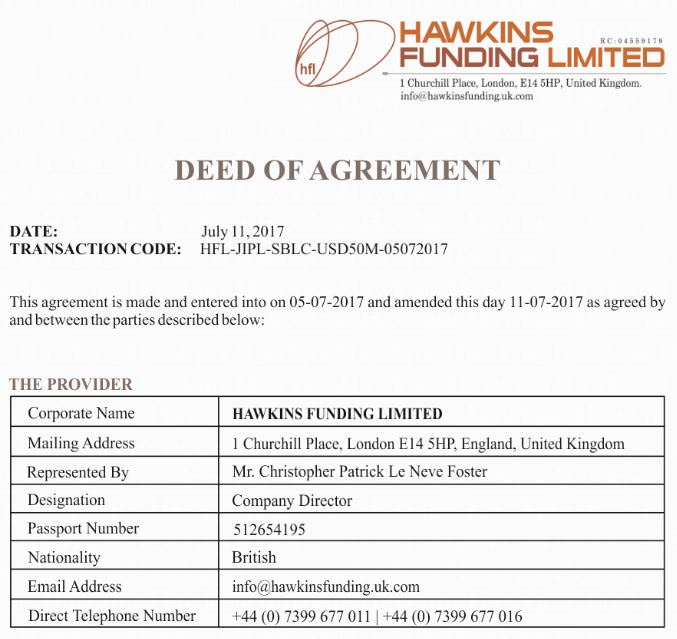

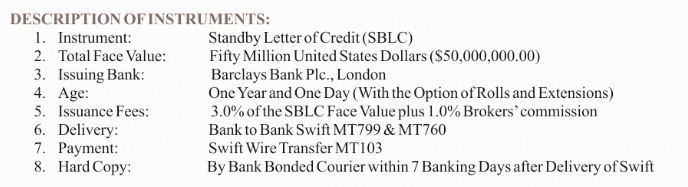

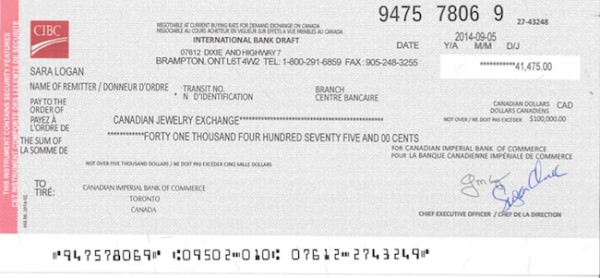

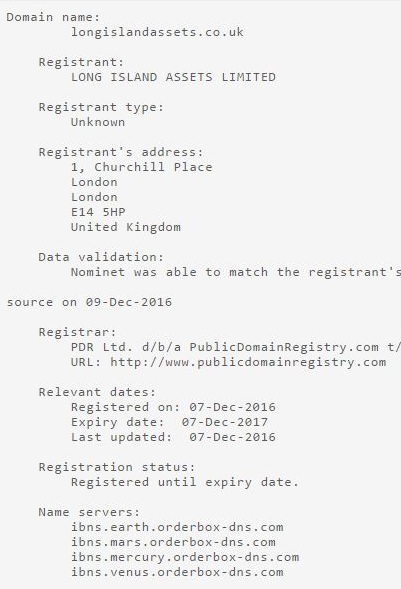

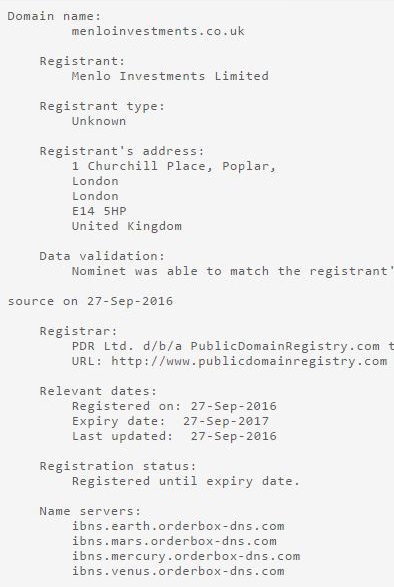

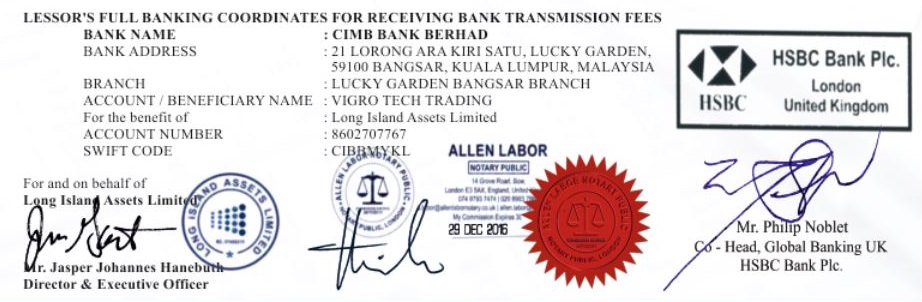

Broker Success Secret 4: Eliminate Fraud

Broker Success Secret 5: Ask Better Questions

Broker Success Secret 6: Be Direct to Providers not in a Broker Chain

Broker Success Secret 7: Knowledge is Power

Broker Success Secret 8: Don't use Gmail, Yahoo, Hotmail, or MSN

Broker Success Secret 9: FREE Clients have no Value!

Broker Success Secret 10: Greed & Ego Kills Deals

Broker Success Secret 11: Follow the Financial Instrument Rules

Secure Platform Funding Broker Success.... Helping Take You to the NEXT LEVEL!

Join our Broker Program Now! Click Here

The Difference between the 1% and the 99%

1. Rich people believe "I create my life." Poor people believe "Life happens to me."

2. Rich people play the money game to win. Poor people play the money game to not lose.

3. Rich people are committed to being rich. Poor people want to be rich.

4. Rich people think big. Poor people think small.

5. Rich people focus on opportunities. Poor people focus on obstacles.

6. Rich people admire other rich and successful people. Poor people resent rich and successful people.

7. Rich people associate with positive, successful people. Poor people associate with negative or unsuccessful people.

8. Rich people are willing to promote themselves and their value. Poor people think negatively about selling and promotion.

9. Rich people are bigger than their problems. Poor people are smaller than their problems.

10. Rich people are excellent receivers. Poor people are poor receivers.

11. Rich people choose to get paid based on results. Poor people choose to get paid based on time.

12. Rich people think "both". Poor people think "either/or".

13. Rich people focus on their net worth. Poor people focus on their working income.

14. Rich people manage their money well. Poor people mismanage their money well.

15. Rich people have their money work hard for them. Poor people work hard for their money.

16. Rich people act in spite of fear. Poor people let fear stop them.

17. Rich people constantly learn and grow. Poor people think they already know.”

Become a Secure Platform Funding Broker Today - Click Here Now!

IMPORTANT: Discover the Private Placement Program which has earned Investors an Average of 60% per Month Return!

- 100% Capital Protected

- $100K Euro Minimum Deposit

- Successfully Operating since 2008

- Guaranteed 10% Return per Month

- Regulated European Fund

- Withdraw All Funds with 14 Days Notice

Loading...

Loading...